Navy Federal Financial Speed Suits

- Navy Government appears to be positive that they give a number of a decreased rates doing

- For this reason they provide a great $step 1,100 rate matches verify

- If you find a lower life expectancy financial rates and you may Navy Federal is actually struggling to matches it they could compensate you

- But you need certainly to establish they that have documentation and you will jump as a result of specific hoops to be considered

You to definitely cool cheer the company now offers was its therefore-named Mortgage Rates Fits, which once the name means tend to match the interest regarding a rival.

And if you’re able to find less financial rates while you are evaluation looking, Navy Federal tend to match one to rates or give you $step 1,000.

Naturally, the typical constraints incorporate and you’ll need certainly to secure your rates that have Navy Government prior to distribution the speed meets demand.

On the other hand, you will need to promote that loan Guess out of a contending financial in this three calendar times of securing their price, as well as the terms and conditions must be the same.

Simply put, there are probably a good amount of outs getting Navy Government, however if you can muster all that plus they can’t/won’t go people all the way down, you may be capable snag $step one,000.

Speaking of tresses, Navy Government even offers an excellent Versatility Secure Alternative to possess home get fund one lets you decrease your rates up so you’re able to 0.25% if the prices improve doing 2 weeks just before closing.

Navy Government HomeSquad

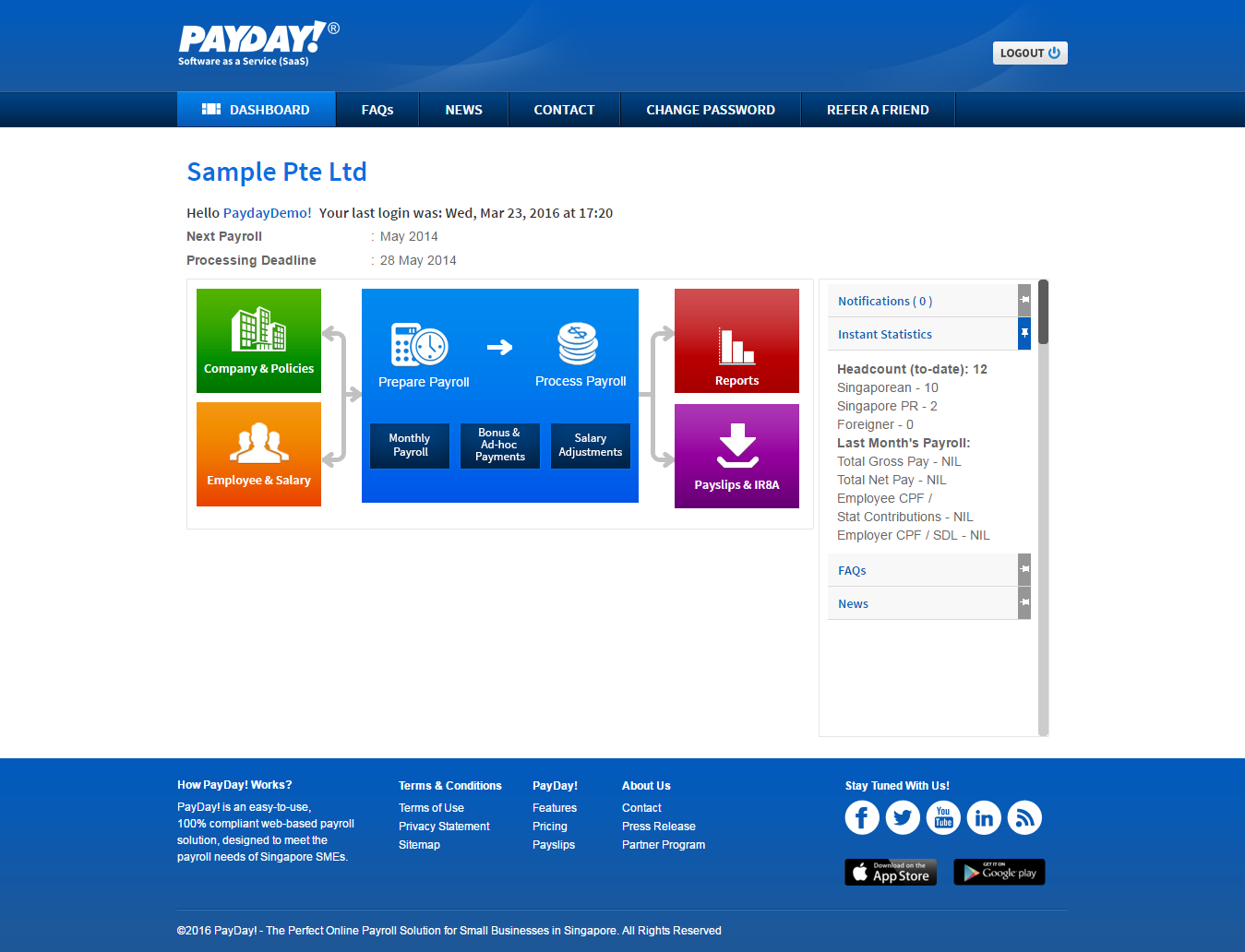

During the mid-2019, it released HomeSquad, that is fundamentally their deal with the fresh new electronic home loan having been becoming increasingly mainstream that have lenders now.

It permits individuals to produce an easy pre-acceptance and also to check financing updates twenty four/eight via their mobile when they are recognized.

Inside the mortgage procedure, individuals is also publish trick loan records such as for example spend stubs, tax statements, letters out of cause, and the like.

It is possible to hook up bank accounts for automatic resource confirmation, and you will sees try sent directly to your favorite product since goals try satisfied.

This particular technology most useful aligns all of them with such Quicken Loan’s Skyrocket Financial, and you may means they are really hard to conquer given its reasonable costs and you may quality customer service.

- Aggressive home loan cost

- 100 % free re also-secure option in the event the cost fall once you lock

- Biweekly homeloan payment alternative

- They services your house loan forever

Whilst long as you are entitled checking account with bad credit to an effective Navy Federal subscription, they’re most likely well worth about taking a look at no matter where your are located in the nation.

They do say giving private advice all the time, very preferably its financing officials is actually better-level according to other big financial officers.

On top of that, as soon as your mortgage loans, they’ll in fact hold onto they into longevity of the loan. This means Navy Government is not just your own lender, and the loan servicer.

It is smoother and less complicated as much loan providers simply originate mortgage brokers and you may easily promote them over to a fluctuate ent entity, creating far more documentation and you may prospective concerns.

With Navy Federal, you can rest assured you will be a debtor forever with them, very they’ll most likely need to take good care of you with each other the way in which.

2 applying for grants Navy Government Financial Remark: Prices Arrive Reduced and so they Maintain your Mortgage

I’m questioning what extra NFCU should re-finance me personally during the this time around. I began a beneficial refi to and you will returned during the dos.5% repaired 30yr Va. My personal speed is only a beneficial until and you will my processor chip generally seems to be stalling. She requests so it and that just in case I provide in order to the girl I wait a week and you will she requires once more to have the same thing. New point she asked for try and therefore Title Organization We ‘m going to fool around with. We in addition to my Label agent keeps emailed my personal processor the fresh new information she means nevertheless she required an equivalent info. Today its approaching my rates secure termination i am also beginning to worry that i seems to lose my rates. Personally i think the financial institution has been doing so it deliberately as I currently have good 4% rates. In conclusion, exactly what incentive really does your own bank need to extremely you will need to straight down the rates?