Imagine if Your Switched Jobs?

You happen to be thinking how your task impacts the home loan when the you turned careers-or turned employment classes. A position transform isn’t necessarily a bad matter. This is also true for individuals who stay static in an equivalent line out-of work along with your salary is equivalent to or greater than everything you made at your past where you work.

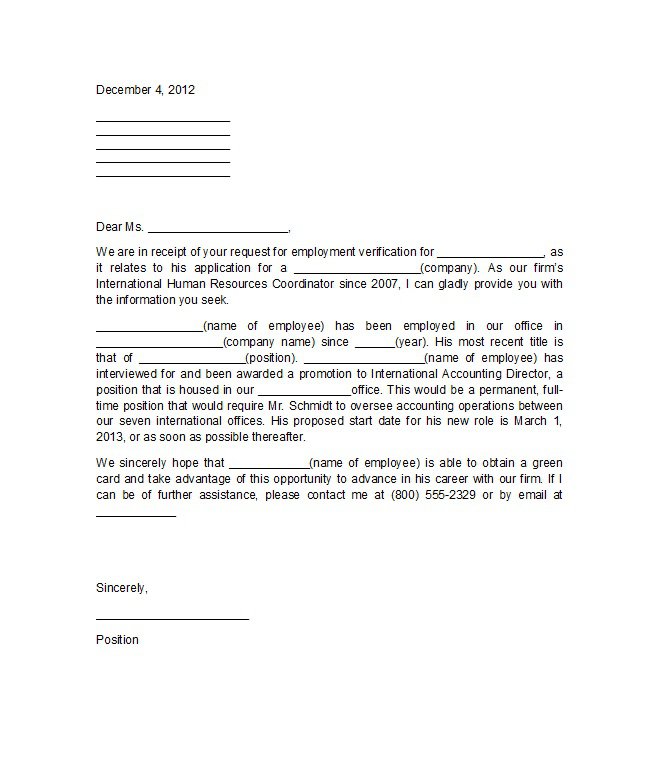

Your own bank get want to know regarding any change, especially if you go from being a beneficial W-2 employee so you’re able to an effective 1099 independent builder, but a tiny need and additional papers will help mitigate this type of inquiries. Lenders can get ask for extra bank statements (one another personal and you can organization), per year-to-go out profit-and-loss (P&L) report, or any other records to ensure new viability of independent a job. Your loan mentor will help by doing a primary writeup on your earnings and you may aid you for you to show the creditworthiness.

Not to care if you have simply graduated regarding college and can’t reveal 2 yrs off a position. Of many lenders usually matter your time in school as part of your job record when your degree is during a connected field. Holes inside the work can also be said by using some time off to increase a family or look after more mature moms and dads. Loan providers may prefer to dive greater into your job background to help you guide you had been a typical worker until the break, but if the gap is readily explained, it isn’t always a great deal-breaker on a home loan application.

What is very important you can do during this time was the truth is with your mortgage coach. They may be able address how your job affects the home loan or respond to questions a keen underwriter could have if you find yourself imminent regarding the state. This includes all of the earnings present, debts, previous high commands, and alterations in employment otherwise earnings. Think of, your loan advisor is the buddy! They would like to view you in your dream home and are usually happy to help and come up with one occurs in the standards.

Let’s say Your Changes Services If you are Obtaining home financing?

You realize one to whole benefit of trustworthiness? Let’s keep one supposed! Always be certain together with your loan coach concerning your business disease. Even if the business changes was very last minute. Even though you feel it reports often disturb the process. Due to the fact right here is the point: lenders will probably make sure you may be however employed by anyone who you noted on your home loan software over the last week in advance of the loan are signed.

Discovering that you will be not employed by you to providers-or that you’ve made an enormous-ticket purchase particularly a car, motorboat, otherwise chairs-during the underwriting techniques normally ultimately replace your official certification and can get noticed as a red-flag by underwriters. However, for those who inform your mortgage coach of the transform they may be able help you to help you enhance your posts and make certain any data is perfect through to the loan shuts.

Faith united states, such nothing omissions would not squeak by the. The worst thing you prefer would be to trust you eligible to financing, made an offer to the property, and claimed that offer . . . in order to read really late regarding games that you are no longer licensed and your mortgage wouldn’t loans. It is not a fun scenario for everyone-the house vendor and you will lender included!

It’s definitely regular so you can inquire just how your work has an effect on their financial-and you may we’re here to help. Get in touch with an enthusiastic APM Mortgage Advisor today , therefore we is answer any queries loans in Jamestown you have got regarding your particular a career disease.

A home-functioning individual that provides a high credit history, almost no loans, and an extended reputation for steady earnings will have a much ideal sample off securing a mortgage than simply a full-go out W-dos wage earner having less than perfect credit and you may a great DTI off 75%.