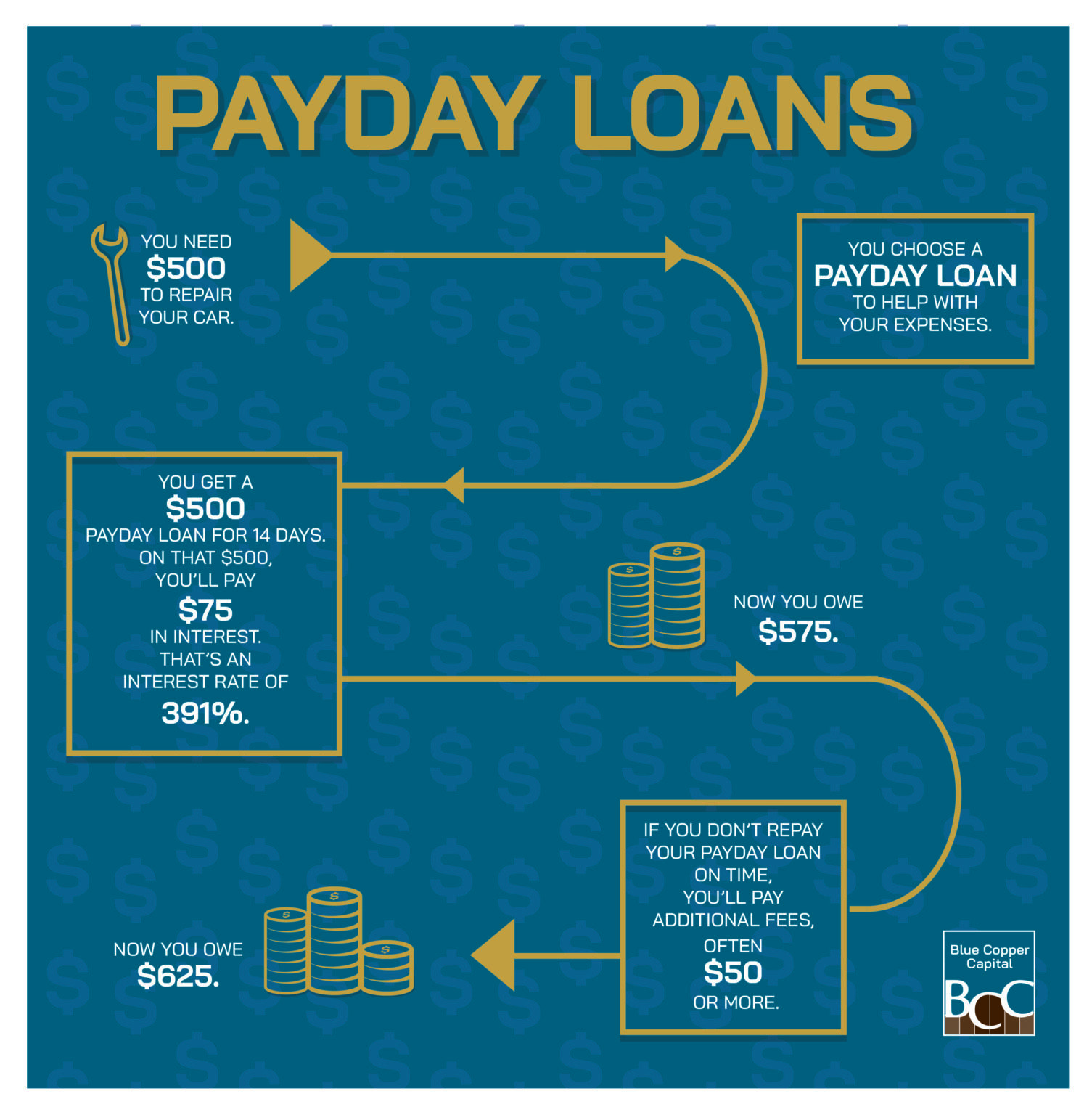

Online payday loans address those with poor credit and frequently declare to have zero lowest credit score and other standards in order to qualify. The latest drawback? An average Apr of cash advance ranges into the numerous, which means you’re paying even more inside focus than in the amount you borrowed. Payday lenders usually victimize somebody desperate for money, however their payment terminology are often impractical to meet.

Even crappy-borrowing cost fund top out which have an annual percentage rate away from %, leading them to a whole lot more reasonable than just probably the better cash advance giving. And some individuals usually see that it is better to pay back that loan which have multiple small repayments unlike an individual high sum. Prolonged loan words is drop off these monthly obligations after that, deciding to make the repayment financing a whole lot more in check.

If you are looking to possess an alternative choice to immediate online pay day loans, speak to your credit connection. Of numerous have started offering pay check-alternative funds that provide quick-identity financial support having an optimum Annual percentage rate regarding twenty-eight%.

Were there No-Credit-See Repayment Financing?

Some lenders uses merely a mellow credit score assessment when providing financing instead of requesting a difficult pull on your credit score.

No-credit-look at installment money act like cash advance in this they render choice to people that have less than perfect credit, nevertheless downsides have a tendency to outweigh the huge benefits. No-credit-check installment finance can occasionally feature an extremely high origination fee and punitive interest levels. Alternatively, communicate with a credit partnership to work through a better bargain.

Do Fees Fund Hurt The Borrowing from the bank?

The only real almost every other manner in which a fees loan is hurt their borrowing is if you miss your instalments. You can look at to increase the loan words to lower the brand new monthly premiums and avoid it out of going on.

What Minimum Credit rating Do you need to own an installment Mortgage?

Additional loan providers has actually some other requirements. Extremely will require a score of at least 600, and others much more stringent while having minimums of 640 otherwise 680.

Could you Pay a repayment Mortgage Very early?

Yes. However, definitely see the loan terms and conditions since particular lenders possess punishment to possess very early costs. Very try not to, but just such as the origination payment, knowing such penalties helps you prevent slutty surprises regarding the coming.

- Zero lowest annual money needs

Because of Upstart’s novel underwriting design, the firm has no the absolute minimum credit score limitation. Rather, the financial institution takes into account many other items to influence their eligibility getting a personal loan.

In general, individuals cannot have fun with SoFi personal loans to begin with a different business, pick a home, otherwise loans money or securities orders.

Apr Range

LendingClub’s Apr initiate from the eight.04% and you can limits out in the %. There is absolutely no disregard for choosing the fresh autopay choice, however, people with seemingly a good credit score results could qualify for an attractive interest.

Given that a personal bank loan represents an elevated exposure towards financial, rates are usually high. Doing this allows the lender in order to mitigate exposure by event alot more currency regarding lifespan of the americash loans Choccolocco mortgage.

Origination Fees

You can even listed below are some aggregator sites to support the fresh software procedure. These sites send-out your data to different loan providers and you can started back with rates that one may next view at the recreational. It streamlines the program processes and helps you notice the best fixed-rate loan for your requirements that have shorter effort and time.

Of several loan providers bring specialized repayment fund that help somebody consolidate its personal debt. The lender usually dispersed the loan number within various loan providers, allowing you to work with repaying one loan as opposed to multiple loan providers. Check out all of our help guide to an informed debt consolidating financing getting considerably more details.

If you’re incapable of meet with the minimum credit score wanted to be eligible for a personal bank loan, you might think one to a quick payday loan is an excellent alternative.