A great deal envision and energy enter going for and you may obtaining a home loan, it’s easy to forget one to closure inside is not necessarily the stop of range. As an alternative, it will be the start of a search that will history age.

Wait for alterations installment loan Cleveland in who covers the home loan.

![]()

Since a resident, your financial is an individual liability. To have a loan company, its an asset – the one that can be purchased and sold as with any other financing.

Immediately following closing, you may find your own financial is actually timely on the run. It is rather prominent for loan providers to market the fresh new rights to get your own dominating and you can appeal repayments. In that way, it discovered bucks capable use to originate even more mortgages having almost every other consumers to shop for property. It means you happen to be and then make your month-to-month home loan repayments so you can yet another entity that bought your loan.

The mortgage company also can promote the fresh new servicing of the financial. This new maintenance of mortgage involves obligations for example gathering your payments, managing your home income tax and you will insurance policies money and you may issuing taxation models.

The optimum time to discover more on good lender’s motives that have their financial is before you even apply for they. Ask your financial who happen to be repair your own mortgage shortly after closing. Offered how important a home loan would be to debt believed, you will need to be assured it could be treated efficiently and you can which have receptive service.

Do a mortgage document.

Once closing, you’ll walk off having a collection of domestic secrets and a keen tremendous bunch away from data. Try keeping at least one backup of any document closed throughout closure. Observe that the deed and you can mortgage documentation are usually submitted within a district courthouse, where it end up being social number.

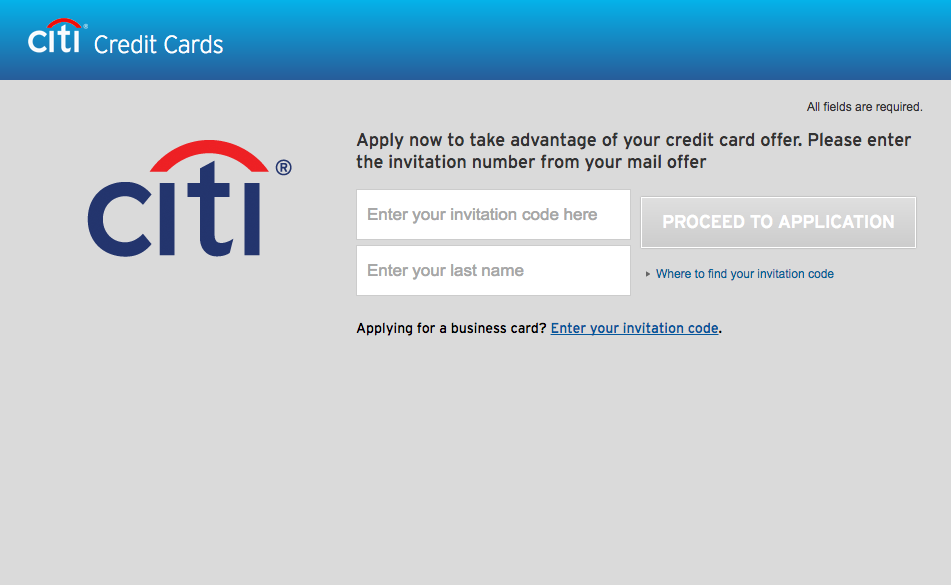

Get ready become swamped that have even offers.

You understand how we simply told you their action and home loan end up being public records? This is why you need to batten down the hatches for a ton from sales pitches of all sorts on the mailbox.

You’re getting such solicitations just like the deed and you will financial was basically filed in public areas information which is used by almost every other providers during the sales.

Those types of pitches might be for household warranties. In case your merchant didn’t give that, you ought to learn the advantages and disadvantages out-of domestic warranties prior to you get you to.

You will also getting encouraged to buy insurance. If you will never be the only one way of living below your brand new roof, it might add up to adopt insurance, which means that your survivors will have currency to repay the borrowed funds and gives for other personal debt. It is very important buy the form of life insurance policies meticulously in order to cover your loved ones.

Miss PMI if you can.

When taking on the a normal financial while making an all the way down percentage from below 20% of your own purchase price, you can generally have to pay for private home loan insurance policies (PMI) each month. That it insurance rates will not include you but alternatively the lender from your chance of defaulting for the loan.

For some funds new PMI at some point come-off, however in some instances can certainly be removed before at the borrower’s request in case the collateral at home are at a pre-calculated count. Look at your loan files or phone call your own financial servicer to know brand new terms of your loan.

Learn their escrow.

If your home loan servicer is actually collecting your home taxation and you can residents insurance costs on the payment, this cash is stored in what is actually named an escrow membership. Brand new servicer tend to remit percentage out of your escrow membership toward appropriate organizations. Typically, those costs are formulated per year. Remember your general mortgage payment you’ll fluctuate having transform on your possessions taxation and you will home insurance premium owed. Your servicer will offer your a yearly escrow membership statement and inform you on changes in the escrow of these numbers.

Anticipate their mortgage income tax versions.

Whenever filing your federal income tax go back, you happen to be able to subtract the interest you repaid on the your own financial regarding submitting seasons. The mortgage servicer reports the amount of attract playing with Irs Form 1098. Make sure you hold back until you receive this type to document their taxes, you do not overlook a prospective deduction. Latest income tax reform change limit the notice deduction getting mortgages, so be sure to consult your income tax advisor about your private situation.

Display interest levels.

If the home loan interest rates shed, you may also make use of refinancing. Which are often a less complicated circulate with an excellent Virtual assistant financing, as opposed to conventional loan, by refinancing that have a beneficial Va Interest rate Reduction Home mortgage refinance loan. An excellent Virtual assistant IRRRL brings a streamlined processes to own refinancing having typically no requirement for a property appraisal much less papers.

The decision to re-finance shouldn’t be produced lightly. Refinancing may end upwards costing you more income along side a lot of time run, particularly if you have been paying on the existing home loan for a couple ages. When considering the choices, check out the closing prices to refinance, your prospective discounts and exactly how longer you plan to stay at your home.

USAA Domestic Understanding Heart brings informative a residential property guidance, products and tips to guide your own excursion. Stuff could possibly get speak about situations, has actually or characteristics you to USAA does not provide. I promote no particular service.